Table of Content

Keep in mind, however, that mortgage lenders can set their own requirements on top of the minimum guidelines used by HUD. This is referred to as a lender “overlay.” Some mortgage lenders require higher credit scores then the 580 minimum mentioned above, for borrowers who want to use an FHA loan to buy a duplex. So the credit requirements can vary from one mortgage company to the next. Some VA eligible buyers want to know, “Can I buy a multifamily home with a VA loan?

Whether you’re looking for an owner-occupied property or a much bigger apartment complex, here’s a brief breakdown. All applications for new construction and applicable refinancing proposals must participate in a Concept Meeting. In order to get an FHA loan, a home or building does have to pass an inspection. It also helps protect the buyer and the lender from any unexpected expenses. An FHA loan could drop that down payment of 20% or more to as little as 3.5%.

Can You Buy a Multi-Family Home With FHA Financing?

So you will have to come up with just a $983 mortgage payment per month versus $2,483 saving $1,500. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. Most lenders will go up to $1,000,000 and review higher loan amounts on a case-by-case basis.

Three units — a three-unit property treated as a single-family home. FHA loans are a federally supported program that allows persons with a low down payment, bad credit, or other financial challenges to purchase a home. We do not offer or have any affiliation with loan modification, foreclosure prevention, payday loan, or short term loan services. Neither FHA.com nor its advertisers charge a fee or require anything other than a submission of qualifying information for comparison shopping ads.

Browse Questions About Mortgage Topics

The FHA, now an agency within the Department of Housing and Urban Development, insures loans originated by private, approved mortgage lenders. As a result, homebuyers can purchase single-family and multifamily properties with a low down payment. The FHA insures loans for multifamily properties through various programs. Department of Housing and Urban Development-backed agency that guarantees multifamily housing loans.

Purchasing a multi-family property is usually a major investment. Having a non-occupying co-borrower can help you qualify for a loan that you might not have been able to get on your own. It is important to remember that the non-occupying co-borrower is not an owner or occupant of the property, so they will not have any responsibility for the property after the loan is closed. You must live in the house you are planning to buy as your primary residence.

Buying a Multi-Unit Home With an FHA Mortgage

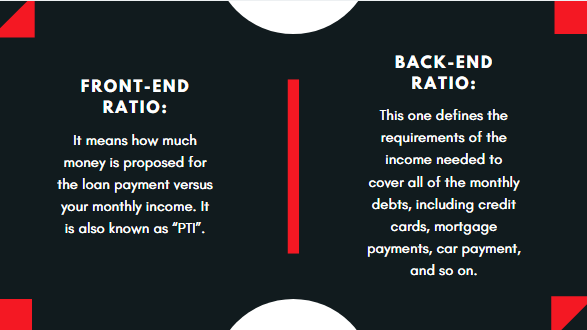

In summary, if you are considering buying a multifamily home, there are amazing low down payment loan options. If you’re looking to buy a multifamily home in the form of a property with no more than four units, you’ll only need to apply for an FHA residential loan. Typical lending requirements for an FHA loan include a credit score of at least 580 and a debt-to-income ratio below 45% for the best chance of qualification. Lenders also typically require an appraisal of the property being purchased. Investing in a multifamily property is a great way to grow your real estate portfolio and bring in additional income. Owning multifamily properties can be a small endeavor or large undertaking, depending on the number of rental units that the property contains.

When using an FHA loan to buy a duplex home, borrowers are generally required to make a down payment of at least 3.5%. Specifically, that’s 3.5% of the appraised value or the purchase price, whichever is less. The Department of Housing and Urban Development refers to this as the “minimum required investment” for borrowers, or MRI for short. One of the most important requirements has to do with owner occupancy.

The following are the “ceiling” FHA loan limits for high-cost areas:

You may also want to invest in some cosmetic upgrades, like new doorknobs, light fixtures, cabinet pulls, and a fresh coat of paint. Bear in mind that you might find you’re able to attract more tenants or even increase your rent – not to mention overall net operating income – with the help of these upgrades. You’ll want to lean on your agent for insight and advice when making an offer. Your agent will meet with the selling agent and act on your behalf, so before they do so, it’s important to determine the absolute highest offer that you’re willing to make .

This FHA loan calculator can help you figure out your monthly payment and mortgage insurance payments. A Property having five or more units meets the FHA’s definition of multifamily. The majority of this article will focus on properties that fulfill a more consumer-centric purpose of “multifamily,” such as single-family homes with two to four units rather than apartment complexes. Below monthly payment is calculated based on $2,483 and subtracting $1500 which is the average monthly rental price in the U.S.

Be smart when it comes to your FHA loan and your financial future. A good FICO score is key to getting a good rate on your FHA home loan. Maximum loan amount per unit - $64,026 for zero bedrooms and up to $123,193 for four or more bedrooms. He specializes in economics, mortgage qualification and personal finance topics. As someone with cerebral palsy spastic quadriplegia that requires the use of a wheelchair, he also takes on articles around modifying your home for physical challenges and smart home tech.

FHA loans are a popular financing option for first-time homebuyers and those with limited resources or credit history. But did you know that you can also use an FHA loan to finance the purchase of a multifamily property? With an FHA loan, you can purchase a multifamily property with as many as four units. The down payment requirements are lower than for a conventional loan, and you can have a lower credit score and still qualify. If you’re thinking about purchasing a multifamily property, here’s what you need to know about using an FHA loan to finance the purchase. The down payment for a multifamily property may be significant, and the monthly rental income adds to the home’s equity.

An FHA multifamily loan is a loan made by a lender and insured by the Federal Housing Administration to purchase a property with five or more units. Occupancy is a requirement for any property you buy with an FHA single-family mortgage loan whether you are a first-time buyer or not. FHA loan rules require a minimum of 3.5% down, though seller contributions to closing costs can help a new borrower better afford that down payment. A 203 loan, also known as a rehabilitation loan, is used to buy uninhabitable properties, or properties that need to be repaired to HUD standards. A 203 purchase loan includes additional funds for property rehabilitation and improvements after closing.

I am also offering a FREE mortgage analysis to determine if refinancing is right for you. You may also then be able to get another FHA loan for another multi-family property and repeat the process. Another big qualification is that you have to live in the multi-family property in order to get the loan. That’s because, generally with multi-family properties the down payment has to be considerably more than it does with a single-family home.

Credit Score

Multi-unit properties to be purchased with FHA loans are subject to the usual FHA minimum standards, just as with single-unit residences. The FHA multifamily acquisition loan is the best option for most borrowers because it can be utilized to buy or refinance existing multifamily properties. Money will not get you experience, but the experience will bring you money. Commercial banks when lending money for 5 or more units check experience as a factor that can lower your risk and mortgage rates. If you’re interested in becoming an investor or a property manager, purchasing a multifamily home is a wonderful hands-on learning experience. Managing several units at once will give you real-world expertise that will come in handy when you expand your portfolio.

But an investor who does not plan to live in the property is typically limited to conventional financing. Loan TypeMax % of Appraised ValueConventional Loan70%With a successful rental situation, owning a multifamily home may be one of the best ways to quickly and affordably build an investment portfolio. HUD’s Section 811 helps provide financing to purchase rental housing for low-income disabled adults. The program also provides rental assistance to state housing agencies to keep costs low for potential tenants. HUD’s Section 202 will help finance the purchase or refinance of properties used to provide housing for low-income elderly people.

No comments:

Post a Comment